New Delhi [India], October 7: Punjab just got a productivity shot in the arm. The GST rate cut, from 12% to 5%, isn’t just a tax tweak; it’s an industrial adrenaline rush. From textiles to bicycles, artisans to MSMEs, Punjab’s economy is now geared for an affordable, competitive, and employment-rich future.

The Tax Cut Heard Across the North

In India’s economic playbook, few moves pack the punch of a well-timed tax reform. The recent GST reforms in Punjab, slashing rates from 12% to 5% across key sectors, are exactly that.

This isn’t about marginal relief. It’s about turning Punjab’s traditional strengths, agriculture, textiles, handicrafts, dairy, and bicycles, into next-gen growth engines. Lower taxes mean cheaper products, fatter margins, and happier consumers. Or in simple terms: Punjab just got its competitiveness discount renewed.

The result? A 6–7% retail price drop across categories like food, apparel, and agro-products. That’s the kind of math consumers love and manufacturers dream about.

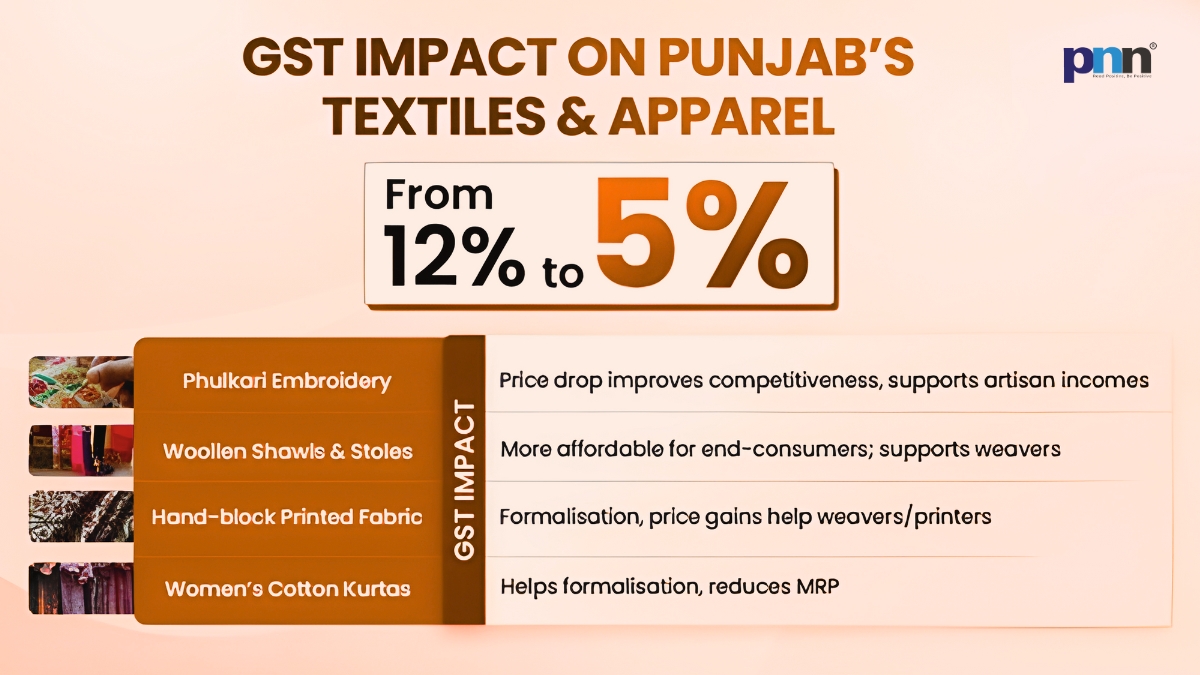

Textiles: The Fabric of a Revival

Punjab’s textile sector already has a pedigree. Ludhiana’s mills, Amritsar’s artisans, and Patiala’s craftswomen make everything from Phulkari embroidery to hand-block prints. Now, they’re getting a tax cut that could redefine margins and market share.

With GST down from 12% to 5%, the entire textile chain, from spinners to exporters, breathes easier. Costs go down. Demand goes up. And for once, artisans don’t have to choose between tradition and survival.

Let’s break it down:

- Phulkari embroidery, crafted by 20,000 women-led artisans, now hits global shelves cheaper. With stronger exports to the US, Canada, and the UK, Punjab’s heritage is going global again.

- Woollen shawls and stoles from Ludhiana get new life; affordability meets global appeal.

- Hand-block printed fabrics, once struggling with high input costs, now look appealing to boutique buyers and D2C fashion brands.

- Women’s cotton kurtas, Punjab’s unsung fashion export, get a price advantage on e-commerce shelves and in international markets.

In short, the reform isn’t just cutting taxes, it’s cutting excuses. If Punjab’s textile players can’t grow now, the problem isn’t policy.

Footwear: The Punjabi Jutti Marches On

If you’ve ever seen a Punjabi Jutti, you know it’s an art you can walk in. Handcrafted, colourful, and globally adored. The only thing not charming? Its price tag, until now.

Thanks to the GST cut, Punjabi Juttis, crafted by over 15,000 artisans in Patiala, Amritsar, and Fazilka, get a fighting chance in both domestic and export markets. Designer brands and wedding markets will feel this impact first.

This isn’t charity, it’s smart economics. When traditional crafts become affordable, they don’t just survive; they scale.

Handicrafts & Wooden Wonders: From Heritage to High Street

Punjab’s woodcraft artisans have always been storytellers with chisels. From intricate lacquer toys in Amritsar to luxury furniture in Hoshiarpur, every product carries a legacy. But legacy doesn’t pay rent.

With GST now at 5%, these artisans finally see daylight. Lower prices make handcrafted wooden products more attractive to boutique buyers, architects, and exporters. The sector, employing 8,000+ carpenters, now competes not just on nostalgia but on price and design.

And those wooden lacquer toys? The 3,000 artisans crafting them now have reason to smile. Lower costs mean higher demand, especially from a world rediscovering sustainable toys over plastic junk.

Metalware & Utensils: Steel, Brass, and a Shot of Confidence

In Ludhiana and Jalandhar, the clang of metal is the soundtrack of livelihood. Here, thousands of MSMEs forge steel kitchen utensils, brass lamps, and copper wares that grace both homes and hotels worldwide.

With GST dropping from 12% to 5%, the industry’s biggest headache, thin margins, has just been eased. Lower taxes mean cheaper retail prices and stronger export pricing.

Let’s talk scale:

- Over 25,000 workers make stainless steel utensils for both home and HoReCa markets.

- Another 5,000 artisans craft brass and copper items for the ceremonial and wellness sectors.

When taxation backs tradition, competitiveness stops being a dream and starts being a spreadsheet reality.

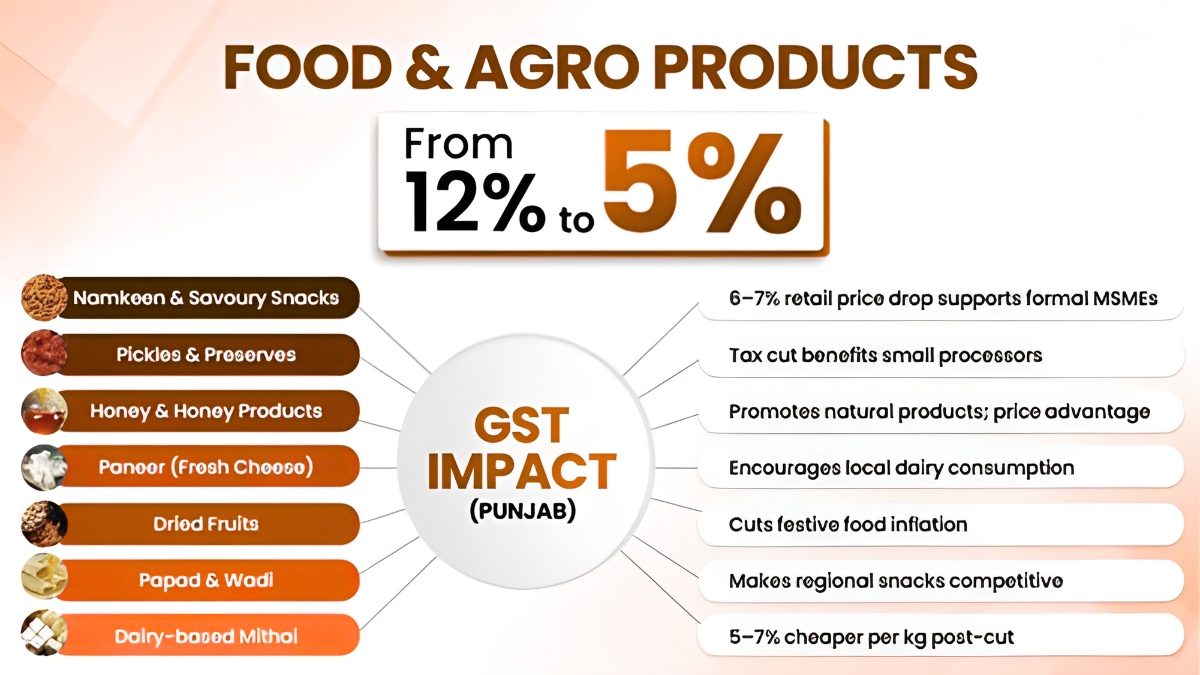

Food & Agro: Punjab’s Taste of Reform

Punjab feeds the nation, and now, its food MSMEs finally get a seat at the reform table.

The GST reduction to 5% for dairy, agro, and food products slices retail prices by 6–7%. The immediate winners? Small producers and women-led enterprises who now see improved margins and better market access.

Consider the lineup:

- Namkeen & snacks: 30,000 workers strong, now producing more affordable munchies for domestic and export shelves.

- Pickles & preserves: women-led SHGs in Gurdaspur and Hoshiarpur find their jars of spice more profitable.

- Honey products: 15,000 rural beekeepers see demand buzzing again, with new export potential to the Middle East and the US.

- Paneer & dairy items: 40,000 people in the dairy value chain benefit from lower input taxes and rising consumption.

- Papad and wadi: iconic Punjabi snacks get formalised into GST-compliant microbusinesses.

- Dairy-based mithai: 10,000 sweet-makers in Amritsar and Ludhiana will tell you, the only thing sweeter than their product now is the tax rate.

This isn’t just fiscal housekeeping. It’s economic justice for small producers who form the backbone of Punjab’s food heritage.

Bicycles: Pedalling Past the Tax Drag

Ludhiana’s bicycle industry is not just a legacy; it’s a logistics lifeline. With over 40,000 workers employed across factories and MSME units, Punjab’s cycle makers power mobility across India and beyond.

The GST cut from 12% to 5% makes bicycles cheaper for households, schools, and government schemes. That means higher volume sales and better export competitiveness, especially in South Asia and Africa, where affordability is everything.

This move isn’t just about manufacturing; it’s about momentum. Punjab’s cycle industry now gets to ride uphill with a tailwind.

Why These Reforms Hit the Sweet Spot

Let’s skip the jargon. Here’s why these reforms matter:

- Affordability – A 5–7% retail price drop means more buyers, faster turnover, and healthier MSMEs.

- Competitiveness – When input costs drop, exports thrive. Punjab’s artisan exports to the West are back in the game.

- Formalisation – Lower tax rates make compliance feasible for small units. Informal becomes formal, and livelihoods get security.

- Livelihood Boost – Across textiles, dairy, and food, over 200,000 workers stand to benefit directly.

- Cultural Continuity – Traditional crafts like Phulkari and Jutti find modern relevance without losing authenticity.

This is not a small win; it’s a structural upgrade. Punjab, often viewed through the agricultural lens, is repositioning as a diversified powerhouse where manufacturing, craft, and food innovation co-exist.

Punjab as a Reform Model

What happens in Punjab doesn’t stay in Punjab. The GST rationalisation here could be a template for other states balancing tradition and modernity.

India’s larger GST structure has often drawn criticism for being too complex or regressive for small businesses. Punjab’s move shows how targeted tax cuts can deliver visible, people-first outcomes, more sales, more jobs, more exports.

If Delhi or Maharashtra replicated this for their craft clusters or food MSMEs, we’d be looking at a national growth story stitched in the fabric of local enterprise.

The Road Ahead: Growth, but Smart

Reforms open doors, but walking through them requires hustle. The tax cut is the catalyst; execution is the differentiator. Punjab’s MSMEs must now focus on branding, export readiness, and design-led manufacturing.

Government initiatives can only spark momentum. It’s entrepreneurs, artisans, and cooperatives that’ll have to turn it into sustained growth.

If Punjab plays it right, this GST cut could transform it from a state of legacy industries to a laboratory of local manufacturing excellence.

Bottom Line

Punjab just made itself cheaper, sharper, and stronger. This 7% price correction isn’t cosmetic; it’s catalytic. From phulkari looms to dairy cooperatives, Punjab’s real economy just got a policy that actually listens to the people who run it.